Renters renter placer compass less casualty license renting assistance

Table of Contents

Table of Contents

Renters insurance quotes are an essential part of finding the best policy to protect your assets. Whether you’re a student living off-campus, a young professional or a family renting a home, renters insurance is a crucial investment for anyone who rents their living space.

The Importance of Renters Insurance Quotes

Many renters don’t realize that they are at risk for many of the same problems that homeowners face. A landlord’s insurance policy doesn’t protect a tenant’s personal belongings or cover the cost of temporary housing if a rental property becomes uninhabitable. Without renters insurance, tenants are responsible for replacing everything from clothing to furniture to electronics if they are destroyed or stolen. In the worst-case scenario, tenants can lose everything they own and have no financial means to rebuild their life.

What Are The Pain Points of Not Having Renters Insurance Quotes?

Imagine that a fire damages your apartment and you lose all of your worldly possessions. On top of that, you have nowhere to stay while repairs are being made, except potentially a hotel. It’s an expensive, stressful and emotionally disruptive experience that can be made even worse by not having proper insurance coverage to help you through the process.

What is the Target of Renters Insurance Quotes?

The target of renters insurance quotes is anyone who is currently renting a living space, regardless of how long or short the lease agreement is. By obtaining a renters insurance quote, renters will be able to understand the full extent of coverage available, while also comparing policies in order to find one that suits their needs and budget best.

Main Points of Renters Insurance Quotes and Related Keywords

Renters insurance quotes provide a level of financial security that every tenant deserves, and they offer coverage for theft, fire and other disasters that can impact a rental property. Although renters insurance quotes aren’t a legal requirement, they are encouraged to establish financial security and peace of mind during a lease agreement. When choosing a renters insurance policy, it’s important to seek one that fits into your budget and provides adequate coverage.

How I Discovered The Importance of Renters Insurance Quotes

After losing my apartment to a flood that destroyed my belongings, temporary housing expenses and moving costs were almost unbearable. Without renters insurance, I would have been unable to replace my belongings and couldn’t afford the many costs associated with temporary housing, as well as transportation costs to get there.

Thankfully, after getting renters insurance, and the unfortunate events that followed, I was able to replace my lost belongings and have an easier transition into a new apartment.

The Cost of Being Under Insured

Being underinsured can lead to serious financial losses, including medical expenses, damage costs and replacement expenses that a tenant could be held responsible for. Inadequate insurance coverage can also lead to legal problems in the event of someone being injured while visiting the rental property.

What Are The Risks of Not Getting Renters Insurance Quotes?

Not obtaining renters insurance quotes puts tenants at risk of financial loss due to personal property damage, theft, natural disasters and other catastrophic events. A renters insurance policy provides a sense of security and peace of mind, knowing that you won’t be held liable for costs associated with damage or injury.

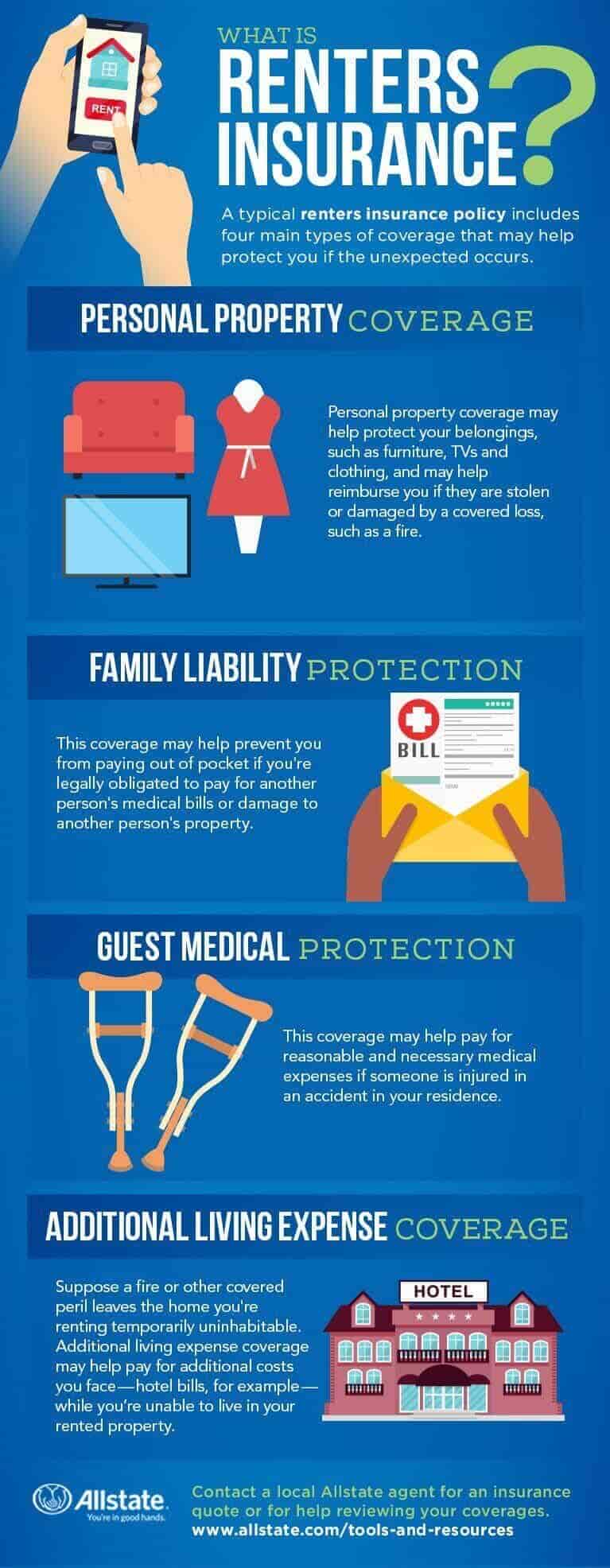

What Coverage is Available with Renters Insurance Quotes?

Most renters insurance policies cover personal property, temporary living expenses and liability insurance. A policy can also cover theft, fire and other natural disasters, which can reduce the risk of financial loss. Additional coverage can also be purchased for jewelry, artwork and high-value items, if desired.

Renters Insurance Quotes Question and Answer Section

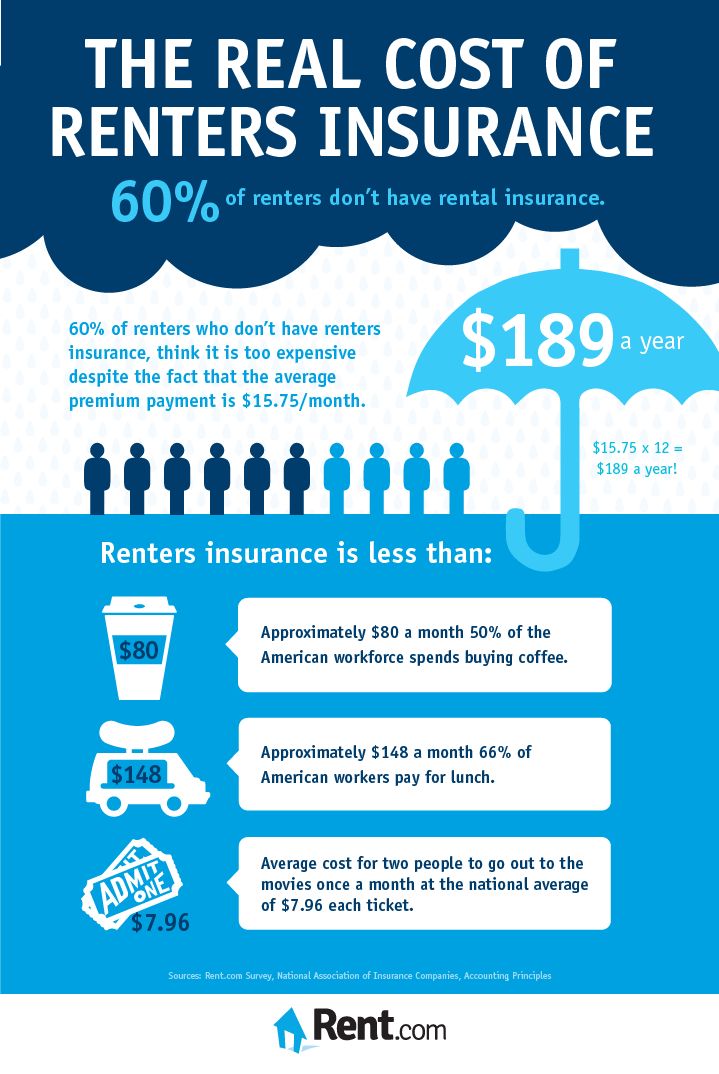

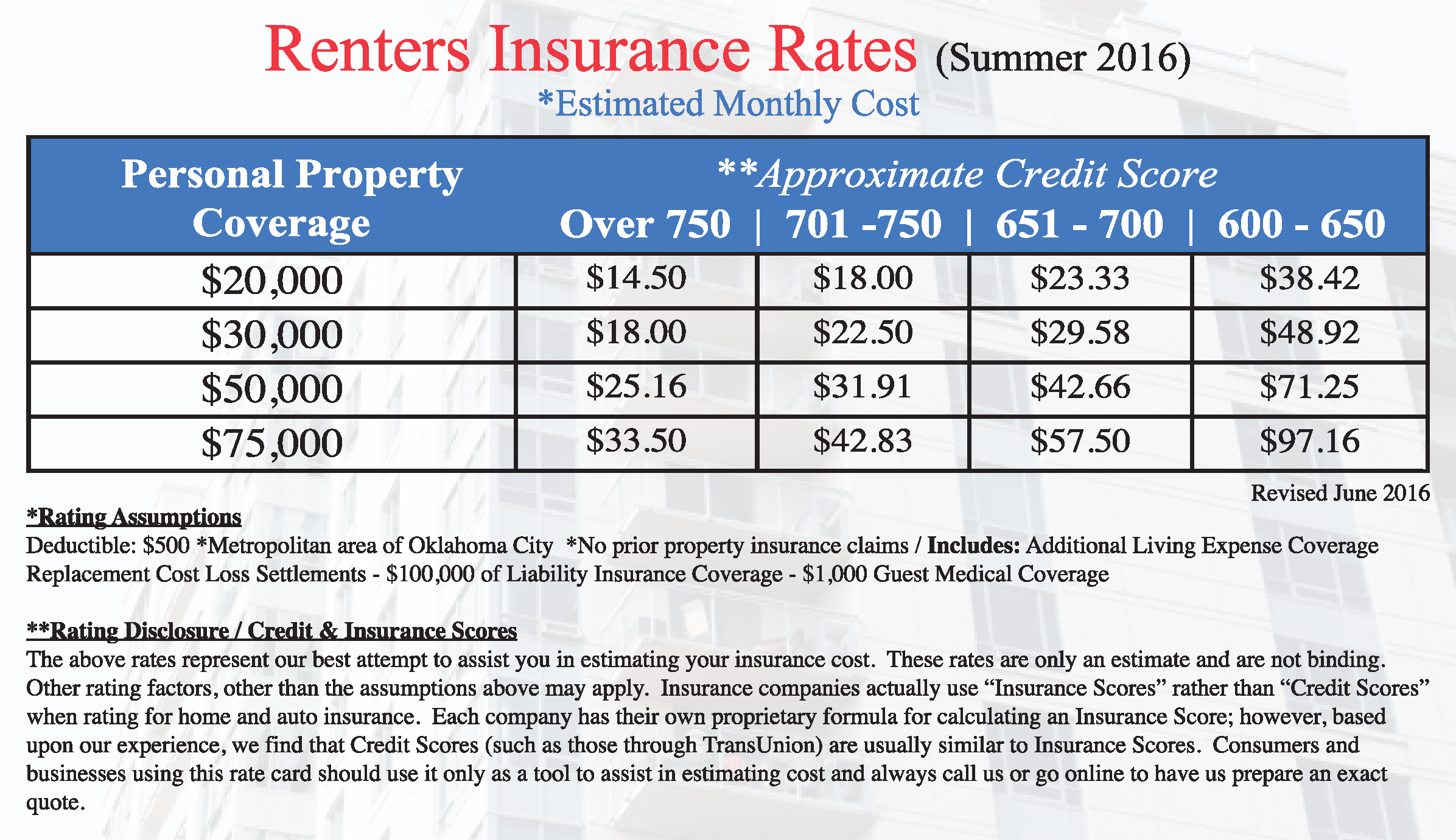

Q: How Much Does Renters Insurance Cost?

A: The amount that a tenant will pay for renters insurance will depend on the policy amount chosen, location, coverage options and deductibles. The average cost of renters insurance is around $15 to $20 a month for basic coverage.

Q: Is Renters Insurance Mandatory?

A: Renters insurance is not mandatory by law, but some landlords may require their tenants to have renters insurance as part of the lease agreement.

Q: What Does Renters Insurance Cover?

A: Renters insurance typically covers personal property, temporary living costs, and liability insurance. Depending on the coverage, protection can include theft, fire, water, wind, and other natural disasters or accidents.

Q: How Do I Know If I Have Enough Coverage?

A: It’s recommended that tenants take stock of their assets and insure them for their full replacement value. A renters insurance agent can help tenants select an appropriate coverage amount.

Conclusion of Renters Insurance Quotes

Getting a rental insurance quote is easy and necessary for anyone renting a living space. Don’t let a catastrophic event financially ruin you, get renters insurance and sleep a little bit better at night.

Gallery

What Is Renters Insurance? | Allstate

Photo Credit by: bing.com / renters allstate types coverages

Renters Insurance Quote | Willoughby Insurance

Photo Credit by: bing.com / renters iii homeowners renter

Do I Need Renters Insurance? - Compass Insurance Agency

Photo Credit by: bing.com / renters renter placer compass less casualty license renting assistance

What Does Renters Insurance Cover In 2020? | Renters Insurance Quotes

Photo Credit by: bing.com / insurance renters does cover quotes

Renters Insurance Guide | Quote | Statewide Insurance Agency

Photo Credit by: bing.com / renters insurance quote company